News > Blog

How Oral Information Management Tools Boost Women’s Financial Literacy and Savings in Ethiopia

Published 12/06/2024 by Jessica Ayala

Savings groups—often referred to as informal community banks—are small groups of people who save together and lend to each other from their pooled funds. Globally, as many as 500 million people belong to savings groups. Approximately 80% of members are women, and many savings groups programs are designed to advance gender equality.

This is the quintessential principle of Global Communities’ Women Empowered (WE) initiative. While helping women access financial resources and build sustainable livelihoods, WE employs innovative solutions to promote women’s participation, leadership and collective action, enabling them to become confident leaders in their homes and communities.

But how can groups achieve the same level of agency and participation for women in communities with low literacy and financial numeracy levels? Nearly 800 million people globally are non-literate and close to one billion are unable to read and write multi-digit numbers. Two-thirds of them are women.

In the South Omo region of Ethiopia, many communities share an unwritten mother tongue and rely on oral or visual communication, preserving cultural history through storytelling traditions. However, the lack of written language can exclude women from formal economies, negatively impact their education and economic opportunities, and make them more vulnerable to exploitation and financial losses.

To address this challenge, the United States Agency for International Development (USAID) Resilience in Pastoral Areas South (RIPA South) project, in collaboration with My Oral Village (MOVE) and private funders, launched a pilot program called WE Record! in 2022. This collaboration set out to trial an Oral Information Management (OIM) solution with 12 WE groups in three woredas in the southern region of Ethiopia. Subsequently, 13 additional groups were engaged in the OIM and numeracy trainings in South Omo.

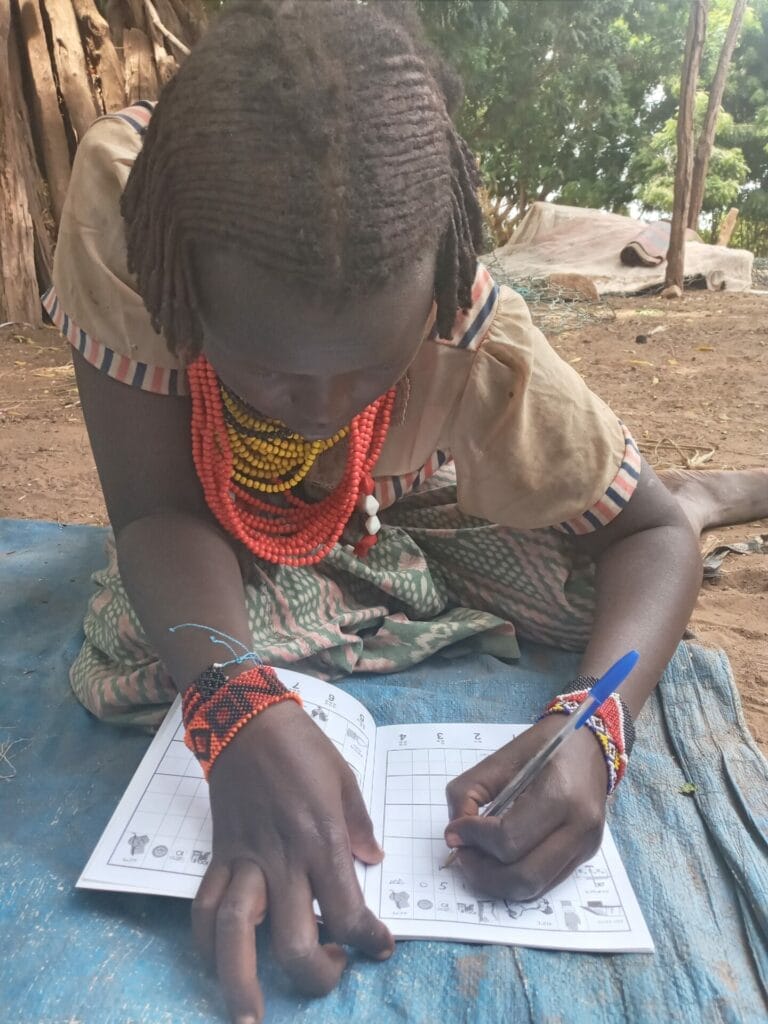

The goal of this initiative was to design visual savings group tools, build the capacity of savings groups members to use them, and foster numeracy and recordkeeping skills. By centering inclusivity, WE Record! also hoped to create a safe environment for deeply oral communities to develop financial literacy and protect their economic investments.

“Before I participated in OIM and my practice group, I was challenged to count over 2000 birr. I lost money selling my livestock because I couldn’t clearly identify notes or count large sums of money. I would sometimes pay a fee to a person who could count and identify notes very well.”

– WE savings group member

The collaboration between RIPA South and MOVE yielded a suite of innovative Oral Information Management (OIM) tools specifically tailored for the financial interfaces of WE groups in this region. The toolkit includes a visually intuitive passbook and ‘mini ledger’, exercise book, training manual, practice group guide, share-out form and share-out guide. These instruments are designed with step-by-step visual instructions, employing two pivotal design innovations, oral iconography and currency frames, to guide members through the WE savings group rules and procedures.

Understanding the WE passbook is critical to participation in savings groups. Typically, the pages are text-based, but in the OIM version, they have been converted to carefully field-tested mnemonic iconography. By retaining the same structure and format, users can build their knowledge of financial syntax when comparing the original and OIM passbooks.

The exercise book supports member learning, because it contains many blank pages and pages with currency frames. Learning depends on doing, and this is where participants practice and can keep any record they wish, such as loans they have given to others or sales they have made in the markets.

Members use the practice group guide as a graphical, step-by-step introduction to numeracy and record-keeping that does not depend on the ability to read.

Annually, groups perform a share-out to capture the performance and contributions, involving a lengthy and arithmetically complex process. The OIM share-out form and guide illustrates how to complete the form and undergo the process to increase participants’ confidence and ensure the long-term sustainability and transparency of the savings group.

This suite of tools not only empowers individuals but also strengthens the financial infrastructure of the communities they serve, marking a significant stride towards inclusive financial literacy and autonomy.

Implementing innovative solutions like OIM in rural settings has shown to help reduce WE savings groups’ dependency on community facilitators, allowing participants to have full control of their finances and creating a safe context for transactions. It’s a step towards bridging the gender gap by creating opportunities for women to take control of their finances through Women Empowered, ensuring they have the resources they need to support themselves and their families.

“[Oral Information Management] is useful for managing our daily financial transactions. When we go to the market to sell and purchase goods and services, we don’t face stress, fear, or need additional assistance because these skills support counting and calculating numbers and transactions so easily that our confidence is increased.”

– WE savings group member, Dasanech Woreda in South Omo

An end-line review of the WE Record! Pilot project provided clear evidence that the OIM tools and solutions helped WE savings group members acquire new skills. At the start of the pilot, only 11% of savings group members could write a 1-digit number and by endline, 69% of the participants could do so. Members’ confidence in and satisfaction with their groups – a critical indicator of sustainability – also rose from the beginning to the end of the project. Their confidence in the accuracy of the ‘share and loan balances’ increased from 70% to 90% and their confidence in their own knowledge of the amount of money stored in their savings group lockbox grew from 58% to 88%.

During the pilot project, the number of groups utilizing this system grew from 12 at the onset of the pilot to 25 total, and 17 were effectively transitioned to independently track their savings, loans and social funds using the OIM passbook and mini ledger.