The post Inspiring Women’s Leadership and Resilience in Guatemala appeared first on Global Communities.

]]>More than 10 years ago, Global Communities planted the seeds of change in Guatemala with the Women Empowered (WE) initiative. What began as a small pilot project in Huehuetenango has flourished into a national movement, driving women’s leadership and social and economic participation through community-based savings groups.

Fueled by innovation and a commitment to continuous adaptation, WE has empowered more than 25,000 Guatemalan women and their families, and inspired generations of women leaders and changemakers. Today, WE is not just a program; it’s a force for transformation.

In this interview, Mabel Bejarano Cobo, our Global Technical Advisor for Savings Groups & Women’s Empowerment, discusses the lasting impact of our WE programming in Guatemala with Ileana Nataly Larios Guillen, our National Coordinator for Women’s Empowerment. Last year, Nataly was honored with the Global Hero Award for her exceptional leadership in supporting thousands of women build financial literacy, grow their savings, invest in income-generating activities, and become leaders in their families and communities.

The conversation was edited for length and clarity.

Mabel: Could you share an overview Global Communities’ work in Guatemala? What are the key components of our programs, and how do we operate to achieve our goals?

Nataly: Global Communities has nearly 50 years of experience in Guatemala, primarily focusing on the western region of the country. Our work encompasses many areas, from humanitarian assistance and disaster risk reduction to food security, women’s economic participation, and primary school education.

We work closely with Indigenous populations, local and national governments, and private sector entities to generate synergies and achieve greater impact. Our approaches include mobilizing individual and collective action, and our primary goal is to support families across the country, mainly in rural areas.

Mabel: Why is promoting the participation and leadership of women important when working on these types of programs?

Nataly: In rural areas of Guatemala, most women work from home, which allows them to play crucial roles in their communities. This includes participation in community-based savings groups, which we form and support. Many women with whom we work demonstrate great leadership potential.

As their self-esteem increases, they begin making decisions, assuming leadership positions and connecting with community structures. Some become catalysts for transformation, mobilizing communities to take collective action and improve the lives of all people.

Mabel: How is Global Communities supporting women in Guatemala? Can you provide one example?

Nataly: Global Communities integrates its signature Women Empowered (WE) methodology into many programs in Guatemala. WE is a global savings group initiative which promotes the expansion of women’s economic opportunities and participation. The impact it generates is truly transformational. When women join WE, they begin a journey up the leadership ladder.

First, they grow their intrinsic power, or “power within.” They begin connecting with the concepts of self-love and self-worth. They see themselves as unique individuals, greater than the sum of their parts. They are so much more than mothers, daughters and wives. They start believing in themselves.

Second, they cultivate their “power with” by joining WE groups with other women from their communities. They bond, offer peer support to each other, and engage in collective action. And third, they assume leadership positions within WE groups, running group meetings, serving as recordkeepers or facilitating group discussions. These roles allow them to gain practical leadership experience. They learn the art of public speaking and decision-making. They become more confident to voice their opinions, share their ideas and advocate for their needs. In addition, they learn new skills, for example financial literacy and entrepreneurship. Ultimately, many WE group members become leaders in public spaces where key positions have not traditionally been available to them. We support them through all stages of this development process.

Mabel: In addition to development programs, Global Communities delivers humanitarian assistance in Guatemala, which is prone to natural disasters. Can you tell us about our WE work in emergency contexts?

Nataly: Global Communities began integrating WE into humanitarian assistance programs in 2015. Since then, we have implemented WE in eight emergency programs: one in response to landslides, one following the eruption of the volcano Fuego, and six to address persistent drought, which has resulted in widespread food insecurity and malnutrition among children.

One of the most important goals of working with WE groups in humanitarian settings is to strengthen women’s resiliency so that they can withstand emergencies, recover as quickly as possible, and be better prepared for future shocks and stresses.

We work with women on many aspects of resilience. As their self-esteem and confidence grow, women have greater ability to make quick and effective decisions when emergencies strike, both alone and together with their spouses and families. Their economic resilience increases, too. They improve their ability to save money for emergencies and manage resources, including multi-purpose cash assistance, after the onset of emergencies. They also gain knowledge and skills to start or expand their income-generating activities, which help them sustain their families through difficult times.

We are also observing women’s greater involvement in disaster response and recovery efforts at the community level. Many WE members join security brigades, manage shelters or become leaders in the food security and nutrition space, especially when their savings groups are formed within emergency food assistance programs. It is important to support them with knowledge and tools to carry out these activities.

Mabel: How are WE groups fostering collective action in their communities?

Nataly: WE groups are much more than informal community banks. They provide safe spaces for women, where they can freely share their opinions and discuss important social issues arising in their communities. Being in these safe spaces allows them to build social capital, trust and connections not only with each other but also with other community members. They gain strength to speak up and be heard. Then, they come together to craft solutions to common problems, design action plans and execute them in collaboration with other community leaders.

Mabel: How does the involvement and leadership of women contribute to the sustainability of our programs?

Nataly: As agents of change firmly embedded within their communities, women can use their new skills and capacities to drive progress even after Global Communities closes a program. They are also changemakers within their own families, educating their children about how to make a difference in their communities.

When daughters see their mothers as positive role models, they are more likely to grow up feeling empowered and become leaders themselves. I am very proud of this lasting intergenerational impact of our work.

Mabel: What is your vision for implementing WE in Guatemala in the next 5-10 years? What are your aspirations for the future?

Nataly: To me and to many women in Guatemala, WE is a powerful tool for lasting impact. It gives women new opportunities, new knowledge, and it opens their eyes to new possibilities. My vision is to grow the initiative and reach even more women across Guatemala. It will be also important for us to expand and strengthen our partnerships with local actors who support women, such as Municipal Directorates for Women, and private donors. This will make WE stronger and more sustainable. The key is to create a base from which women can take the leap forward and pursue new social, leadership and economic opportunities.

Mabel: What is the most important thing you would like our audience to remember about WE in Guatemala? What are you most proud of?

Nataly: WE has changed the lives of more than 25,000 women in Guatemala. We have also improved the lives of entire families. This transformative change brings hope for a future where women have more opportunities and the confidence to use their voice, make decisions and lead.

Mabel: Thank you for your insights, Nataly! How can our audiences learn more about WE?

Nataly: Last year we celebrated 10-year anniversary of WE in Guatemala. You can read our press release here. I also encourage you to explore our visual story, Women Saving for Resilience: Transforming Lives Through Innovative Savings Group Solutions.

The post Inspiring Women’s Leadership and Resilience in Guatemala appeared first on Global Communities.

]]>The post How Oral Information Management Tools Boost Women’s Financial Literacy and Savings in Ethiopia appeared first on Global Communities.

]]>Savings groups—often referred to as informal community banks—are small groups of people who save together and lend to each other from their pooled funds. Globally, as many as 500 million people belong to savings groups. Approximately 80% of members are women, and many savings groups programs are designed to advance gender equality.

This is the quintessential principle of Global Communities’ Women Empowered (WE) initiative. While helping women access financial resources and build sustainable livelihoods, WE employs innovative solutions to promote women’s participation, leadership and collective action, enabling them to become confident leaders in their homes and communities.

But how can groups achieve the same level of agency and participation for women in communities with low literacy and financial numeracy levels? Nearly 800 million people globally are non-literate and close to one billion are unable to read and write multi-digit numbers. Two-thirds of them are women.

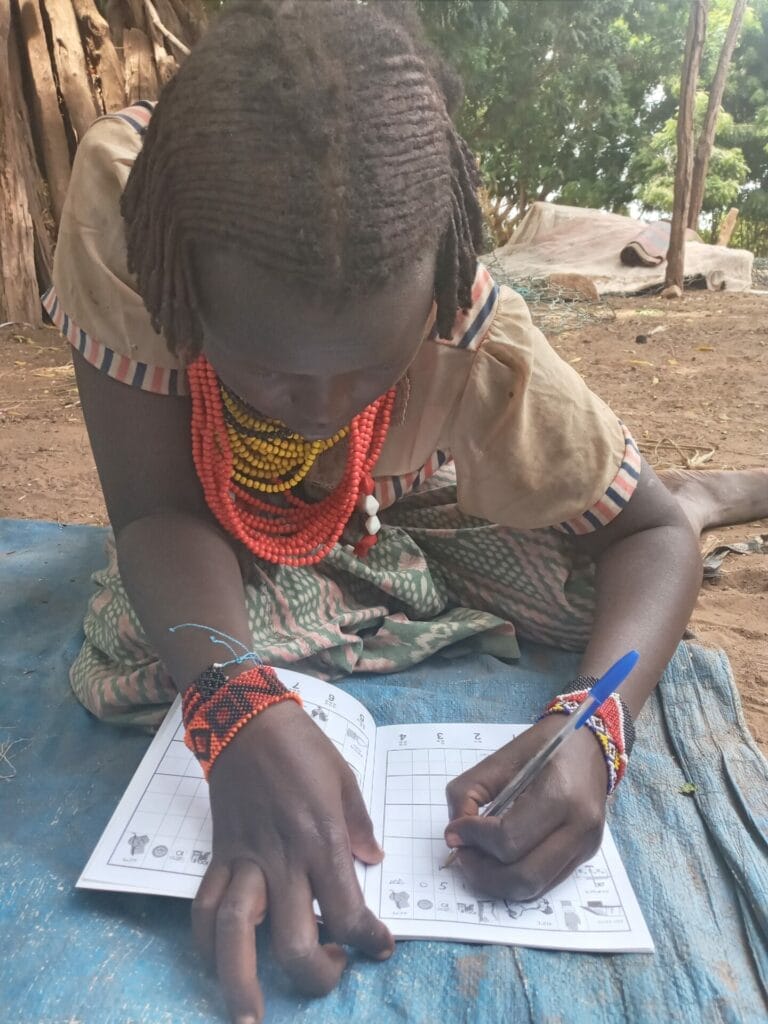

In the South Omo region of Ethiopia, many communities share an unwritten mother tongue and rely on oral or visual communication, preserving cultural history through storytelling traditions. However, the lack of written language can exclude women from formal economies, negatively impact their education and economic opportunities, and make them more vulnerable to exploitation and financial losses.

To address this challenge, the United States Agency for International Development (USAID) Resilience in Pastoral Areas South (RIPA South) project, in collaboration with My Oral Village (MOVE) and private funders, launched a pilot program called WE Record! in 2022. This collaboration set out to trial an Oral Information Management (OIM) solution with 12 WE groups in three woredas in the southern region of Ethiopia. Subsequently, 13 additional groups were engaged in the OIM and numeracy trainings in South Omo.

The goal of this initiative was to design visual savings group tools, build the capacity of savings groups members to use them, and foster numeracy and recordkeeping skills. By centering inclusivity, WE Record! also hoped to create a safe environment for deeply oral communities to develop financial literacy and protect their economic investments.

“Before I participated in OIM and my practice group, I was challenged to count over 2000 birr. I lost money selling my livestock because I couldn’t clearly identify notes or count large sums of money. I would sometimes pay a fee to a person who could count and identify notes very well.”

– WE savings group member

The collaboration between RIPA South and MOVE yielded a suite of innovative Oral Information Management (OIM) tools specifically tailored for the financial interfaces of WE groups in this region. The toolkit includes a visually intuitive passbook and ‘mini ledger’, exercise book, training manual, practice group guide, share-out form and share-out guide. These instruments are designed with step-by-step visual instructions, employing two pivotal design innovations, oral iconography and currency frames, to guide members through the WE savings group rules and procedures.

Understanding the WE passbook is critical to participation in savings groups. Typically, the pages are text-based, but in the OIM version, they have been converted to carefully field-tested mnemonic iconography. By retaining the same structure and format, users can build their knowledge of financial syntax when comparing the original and OIM passbooks.

The exercise book supports member learning, because it contains many blank pages and pages with currency frames. Learning depends on doing, and this is where participants practice and can keep any record they wish, such as loans they have given to others or sales they have made in the markets.

Members use the practice group guide as a graphical, step-by-step introduction to numeracy and record-keeping that does not depend on the ability to read.

Annually, groups perform a share-out to capture the performance and contributions, involving a lengthy and arithmetically complex process. The OIM share-out form and guide illustrates how to complete the form and undergo the process to increase participants’ confidence and ensure the long-term sustainability and transparency of the savings group.

This suite of tools not only empowers individuals but also strengthens the financial infrastructure of the communities they serve, marking a significant stride towards inclusive financial literacy and autonomy.

Implementing innovative solutions like OIM in rural settings has shown to help reduce WE savings groups’ dependency on community facilitators, allowing participants to have full control of their finances and creating a safe context for transactions. It’s a step towards bridging the gender gap by creating opportunities for women to take control of their finances through Women Empowered, ensuring they have the resources they need to support themselves and their families.

“[Oral Information Management] is useful for managing our daily financial transactions. When we go to the market to sell and purchase goods and services, we don’t face stress, fear, or need additional assistance because these skills support counting and calculating numbers and transactions so easily that our confidence is increased.”

– WE savings group member, Dasanech Woreda in South Omo

An end-line review of the WE Record! Pilot project provided clear evidence that the OIM tools and solutions helped WE savings group members acquire new skills. At the start of the pilot, only 11% of savings group members could write a 1-digit number and by endline, 69% of the participants could do so. Members’ confidence in and satisfaction with their groups – a critical indicator of sustainability – also rose from the beginning to the end of the project. Their confidence in the accuracy of the ‘share and loan balances’ increased from 70% to 90% and their confidence in their own knowledge of the amount of money stored in their savings group lockbox grew from 58% to 88%.

During the pilot project, the number of groups utilizing this system grew from 12 at the onset of the pilot to 25 total, and 17 were effectively transitioned to independently track their savings, loans and social funds using the OIM passbook and mini ledger.

The post How Oral Information Management Tools Boost Women’s Financial Literacy and Savings in Ethiopia appeared first on Global Communities.

]]>The post Promoting Women’s Entrepreneurship to Drive Economic Growth: Perspectives from India appeared first on Global Communities.

]]>India has grown into the fifth largest economy in the world. The growth of the country’s gross domestic product (GDP) indicates the existence of a plethora of opportunities that people can leverage to partake in the economy. Over the past decade, there has been a notable increase in the rate of women’s labor force participation. In 2023, this rate stood at nearly 33% as compared to 27% in 2013.

It is pertinent to pause and reflect where the growth in women’s labor force participation is coming from. Approximately 51% of women entrepreneurs and businesswomen in India earn less than USD 120 per month. Yet the recent Periodic Labor Force Survey (PLFS) conducted by the government of India reveals an increase in self-employment among working women, despite dwindling average earnings. This trend partly arises from the pandemic-induced income shocks, prompting women to supplement family incomes and highlighting their pivotal role in stabilizing household finances. According to PLFS data from 2021 to 2022, women are much less likely to work then men, but they are more likely to be self-employed than men (60% vs. 51%). Notably, 60% of working women aged 15 to 59 are self-employed, with around 45% operating their own enterprises. This highlights the urgent need for tailored support to businesswomen so that they can sustain their entrepreneurial journeys.

Reducing Gender Barriers to Entrepreneurship

A journey to entrepreneurship is a complex one, and one that requires sufficient investment of effort, time and money. Women, especially those from marginalized backgrounds, face a myriad of sociocultural and material barriers to their economic advancement, including rigid gender norms, limited education and a lack of mentorship.

It is important to recognize that women entrepreneurs are not a homogenous group. Efforts to support them must be tailored to their needs based upon their unique skills and opportunities, and the specific barriers they face. The best approach is to understand the existing systems and structures – formal and informal – and then both work within these systems to support women entrepreneurs and advocate for systemic changes, including by challenging gender norms and barriers. The key aspects of such a model must include:

- Improving women’s business skills through capacity building.

- Formalizing women’s enterprises where appropriate.

- Enhancing access to schemes and policies of the government.

- Increasing access to finance and financial knowledge.

- Introducing technological solutions to increase productive efficiency.

- Enhancing women’s access to value chains and working to make them more gender-responsive.

- Developing and strengthening peer support networks.

These types of interventions require facilitators to invest time in working directly with women while introducing normative and social behavior change strategies. Projects must be tailored to support participants based on their skills, needs and opportunities. While the degree of customization may vary, tailored and segment-specific methodologies have greater potential to meet women where they are and deliver impact.

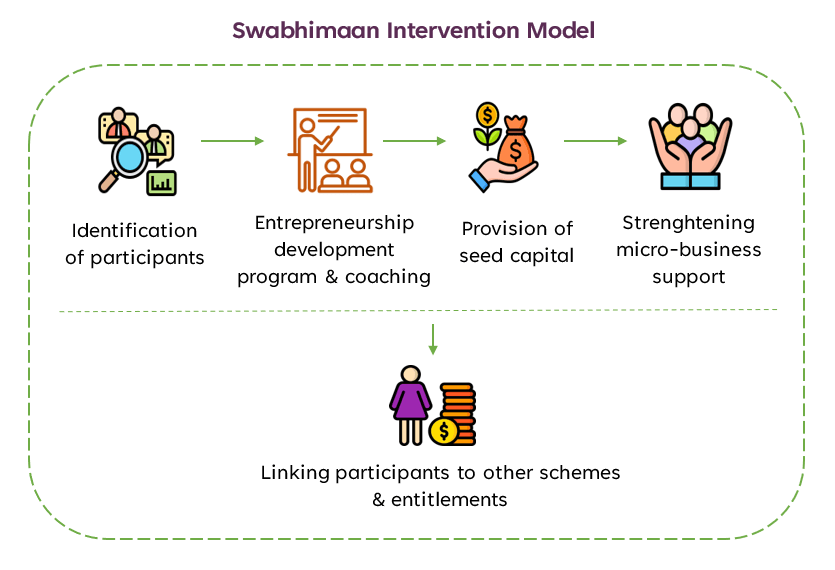

Swabhimaan: Promoting Entrepreneurship & Boosting Self-Esteem

Project Concern International (PCI) India, which is an independent organization localized by Global Communities, has tackled these challenges with its Swabhimaan project. Swabhimaan, which means self-esteem or self-respect in Hindi, aimed to boost women’s incomes and workforce participation through scalable models. This integrated entrepreneurship initiative has supported 15,000 women from low-income households in urban slums and rural areas to thrive as micro-entrepreneurs. The approach includes three distinct entrepreneurship development models:

- Assistance to individual women as they enhance their autonomy and build livelihoods, including through training, coaching and seed capital.

- Enterprise support services for businesses established by the urban poor within the Self-Help Group ecosystem.

- Leveraging government contracts to enhance the role of rural women collectives in market penetration.

PCI India implemented the Swabhimaan project between October 2022 and March 2024, and we are proud of the following achievements:

- 97% of participants are running fully operational businesses since the start of the intervention.

- 90% of participants increased business revenues and income.

- 30% of enterprises accessed institutional financial support mechanisms.

- 52% of enterprises adopted sound financial practices and improved decision-making.

- 80% of enterprises introduced automation of business processes.

- Women with existing businesses stated that a deeper understanding of business operations coupled with implementation of new accounting practices has enabled them to efficiently manage inventory, reduce wasteful expenditure and re-invest revenues into their businesses.

We have learned that entrepreneurship development requires diverse strategies and engagement with multiple stakeholders. It is not always easy but building entrepreneurial aspirations among women from marginalized and rural communities has the potential to generate local employment, increase economies of scale and improve women’s control over resources. This will subsequently lead to a greater investment in the social indicators of health, nutrition and education. Through these collaborative efforts we are working to bring forward inclusive, democratic and equitable change.

About the Author

Irina Sinha is a Director for Strategic Insights and Systems at PCI India. She has over 25 years of experience in the social development of India, especially in the state of Bihar. Recently, Irina spoke at Global Communities’ event, “Fostering Women’s Entrepreneurship at Every Stage: A Cross-Regional Exchange.”

The post Promoting Women’s Entrepreneurship to Drive Economic Growth: Perspectives from India appeared first on Global Communities.

]]>The post Strengthening Economic Opportunities for Women Entrepreneurs through Cooperatives appeared first on Global Communities.

]]>Cooperatives are leaders in promoting inclusive economic growth by providing equitable and accessible solutions to economic and social stressors. Two of the seven principles of cooperatives are “voluntary and open membership” and “concern for community,” both of which call upon cooperatives to create opportunities for all people and to put the betterment of their communities at the forefront. Cooperatives are also a proven avenue for women’s economic advancement, because they provide them with opportunities to become business owners and share in the risks and rewards of entrepreneurship. Through cooperatives women have improved access to training, resources and financial products to grow their businesses and improve their economic wellbeing.

“Initially, I didn’t see self-employment as a viable option for women,” said Judy Boyani, Vision 4 Housing Cooperative secretary. “However, through the business trainings offered by the Vision 4 Housing Cooperative, I’ve not only started my own business but also become a trainer myself. I train other women and girls on essential entrepreneurial skills, from soap making to financial literacy, believing in their potential to greatly contribute to our community.”

Global Communities implements the United States Agency for International Development’s (USAID) Cooperative Development Program called Cooperative Leadership Engagement Advocacy and Research (CLEAR), which coaches cooperatives on successful and sustainable business models. Through cooperative development projects, Global Communities has documented how cooperative membership is empowering women to access economic opportunities and grow their businesses. Since 2018, the CLEAR project has supported 19 worker cooperatives in Kenya through formation and registration and nearly 2,000 women cooperators.

Cooperatives Opening Doors for Women Entrepreneurs

One example of this comes from the Vision 4 Housing cooperative in Kenya. While women in Kenya have the right to own property, strong patriarchal norms mean it is still uncommon for women to inherit or purchase land. However, through membership in the housing cooperative, single and widowed women have greater ability to own land and homes. Lucia, for example, who is a widowed Vision 4 Housing member, has been able to reach her savings goal, purchase a plot of land and build a house for herself and her children. On her plot, she grows vegetables and raises chickens; she also manages a small business out of her home. With a combination of earnings from her business ventures and money that would have been spent on rent, she has purchased another house to use as a rental property.

Cooperatives are opening doors for women entrepreneurs by creating safe and inclusive educational opportunities in traditionally male-dominated industries, such as the energy sector. For example, the Women in Sustainable Energy and Entrepreneurship (WISEe) worker cooperative in Kenya, which has also received support from Global Communities, trains women in solar panel engineering and panel installation. After the training, members are certified through the cooperative, which leads to more employment opportunities than their uncertified peers receive. The cooperative continues supporting members through sourcing installation materials, marketing the products and assigning teams of member engineers to complete installation projects. The WISEe cooperative has created more jobs for women in science, technology, engineering, and math (STEM), and increased job opportunities for their members. WISEe trainings and solar panel services are marketed through social media and mass text messaging campaigns. As a result of these efforts, a recent WISEe training has been sold out and the cooperative has a fully booked schedule.

Beyond the anecdotes from our programs, data shows that 82% of cooperative members in Kenya report directly benefitting from cooperative membership. Women in cooperatives also report having stronger support systems in place for when emergencies occur, since cooperative members tend to turn to each other in times of need.

Entrepreneurship, especially for women, can be daunting with many barriers to entry, including limited access to capital and education, and cultural beliefs around women’s work. The cooperative model has supported many women to develop and grow their businesses in new and emerging markets through improved access to finance and solid social and economic safety nets. In many ways, cooperatives are helping women break through cultural barriers and grow as leaders, all while advancing their businesses and securing stronger economic futures. Donors and implementing organizations looking to improve women’s economic opportunities through entrepreneurship should consider the cooperative model as a more inclusive and risk sharing alternative to single entrepreneur-owned businesses.

Building on lessons learned from CLEAR (2018 to 2023), which supported more than 4,000 cooperative members in Kenya, the CLEAR+ project (2023 to 2028), seeks to expand its reach and scale up the worker cooperative model. Our goal is to continue growing economic opportunities for women and youth within the cooperative sectors in Kenya and Guatemala.

The post Strengthening Economic Opportunities for Women Entrepreneurs through Cooperatives appeared first on Global Communities.

]]>The post Generating Job Opportunities for Mountain Guides and Porters in Kenya appeared first on Global Communities.

]]>Nestled within the scenic landscapes of Nyeri County, Mt. Kenya Guides and Porters Safari Worker Cooperative stands as an inspiring example of the transformative influence of the worker cooperative model in Kenya’s tourism sector. Originating as an informal group in 1971, the cooperative has since flourished into a vibrant enterprise that currently consists of 153 dedicated members.

The cooperative’s journey toward success gained momentum through a strategic partnership with Global Communities, which facilitated a crucial connection to the Nyeri County government. This collaborative effort was made possible under CLEAR, a Cooperative Development Program funded by the U.S. Agency for International Development. Mt. Kenya Guides and Porters’ participation in CLEAR paved the way for essential training sessions encompassing pre-cooperative principles, digital marketing, safety protocols, customer management and recordkeeping.

“The county has been doing its part, Global Communities has been doing its part, but more importantly, the cooperative themselves, they are self-driven,” said Tarichia Kendi, a county executive committee member of Trade, Tourism, Culture and Cooperative Development in Nyeri County. “This is what gives us this commitment to [Mt. Kenya Guides and Porters], because we can see sustainability into the future.”

Specializing in mountain climbing services, Mt. Kenya Guides and Porters’ diverse membership boasts expertise in botany, wildlife, culinary arts and portering. This bolsters the cooperative’s commitment to delivering a comprehensive and enriching experience for tourists. During peak seasons, it formally engages the local community’s unemployed youth and provides them with opportunities to earn income by assisting members in their work.

“Personally, I have benefited financially through the cooperative,” said Elias Githinji, chairperson of Mt. Kenya Guides and Porters. “I have been able to sustain my family. I have been able to educate my children.”

Beyond showcasing the captivating landscapes and exhilarating climbs unique to the country, the cooperative also has emerged as a catalyst for socio-economic development in Kenya.

“We see cooperatives as perhaps the strongest cog in driving the social economic transformation that we are looking for as a county and as a country,” Kendi said.

Learn more about Mt. Kenya Guides and Porters and its partnership with Global Communities and the Nyeri County government in the video below.

This success story is made possible by the generous support of the American people through the United States Agency for International Development (USAID). The contents are the responsibility of Global Communities and do not necessarily reflect the views of USAID or the United States Government.

The post Generating Job Opportunities for Mountain Guides and Porters in Kenya appeared first on Global Communities.

]]>The post Pass the Mic: Growing from Our Roots: Exploring the History and Future of Cooperative Development Programming at Global Communities appeared first on Global Communities.

]]>

Global Communities’ history is deeply rooted in the cooperative movement. Our organization was created in 1952 as the Foundation for Cooperative Housing, and for over 30 years we used the cooperative model to help build 60,000 houses for people in need across 35 states in the United States. In 1962, our programming expanded to Central America, demonstrating that the successful cooperative housing model could be replicated in other countries. In the 1990s, following the fall of the Berlin wall, we began working in Eastern Europe, still heavily focusing on cooperative housing. In Poland, for example, we created a training program to help cooperatives establish themselves in the newly forming post-socialist market economy. By the close of the program, an estimated 4,560 Polish citizens found new homes in more than 1,000 new cooperative housing units across the country. While our name has changed to Global Communities and our work has expanded beyond cooperative development, our commitment to partnering with cooperatives to bring about sustainable, positive change remains the same.

Our current Cooperative Leadership, Engagement, Advocacy and Research (CLEAR) program, implemented since 2018 and funded by the United States Agency for International Development (USAID), has strengthened the cooperative ecosystem in Kenya. CLEAR has supported counties in developing cooperative policies, coached cooperatives to enhance their business performance, and created research and learning products to support cooperative development globally. CLEAR has also introduced the worker cooperative model to Kenya and successfully supported the 10 first ever worker cooperatives through registration and start-up.

While CLEAR is set to close in December 2023, we are thrilled to announce CLEAR+, the next phase of our cooperative development programming. CLEAR+ will strengthen the cooperative sectors in Guatemala and Kenya through improved legal frameworks, advocacy and learning.

I recently sat down with Ashley Holst, CLEAR+ Chief of Party at Global Communities, to chat about lessons learned from our rich cooperative history and how we are planning to apply them in CLEAR+. The interview was edited for length and clarity.

Paula: Congratulations on securing CLEAR+! Amazing news. Before we dive into the future of cooperative development programming at Global Communities, let’s talk about what we have learned from the first phase of CLEAR. How would you define the success of the program?

![]()

Ashley: We learned a lot during the first phase of CLEAR. It has been a very successful program, but achieving the key milestones took a lot of effort. One of the main reasons for that is that we chose to focus on advocacy and education around a relatively new and innovative form of cooperatives called worker cooperatives. We wanted to see how we could use the cooperative model to create more jobs and economic opportunities for folks living in urban areas and working in the up-and-coming service and tech industries. We found that it takes quite some time to build awareness around worker cooperatives. But, once we had the ball rolling and the worker cooperatives started to form, we saw a lot of success and interest in these cooperatives. One of the objectives of the program was centered around policy reform, so we also learned that policy advocacy takes a long time. It requires a lot of community engagement, information sharing, and trust building to shape policies that have local buy-in and are successful in the long run.

Paula: Cooperative businesses play a vital role in advancing sustainable development goals by promoting inclusive economic growth, alleviating poverty and reducing inequality. How has CLEAR contributed to advancing the global development agenda?

![]()

Ashley: One of the most important and exciting aspects of cooperative development is that cooperatives help individuals achieve greater economic security. In addition, cooperatives are inherently inclusive. Any person who meets the criteria of a particular cooperative can join it, which can be life-changing for traditionally excluded or overlooked populations, including women and youth. CLEAR has been very intentional about promoting economic development for women and youth not only by encouraging them to join or form cooperatives, but also to become leaders. In fact, many cooperatives supported by CLEAR in Kenya are led by young entrepreneurs who came together to form worker cooperatives. We designed CLEAR+ to specifically focus on young professionals in the gig economy in such sectors as transportation, tourism and the service industry, like mechanics and construction. The worker cooperative model is a perfect way for youth to have ownership and decision-making in their businesses, while being able to share the risks and resources in the operation of these businesses.

Paula: Cooperatives are also powerful partners in strengthening resilient communities. Could you shed some light on how CLEAR has supported Kenyan cooperatives in building social capital and social cohesion?

![]()

Ashley: Cooperatives support their members and communities with both economic and social capital. Global Communities co-authored a research study with the U.S. Overseas Cooperative Development Council to look at this issue in four countries around the world. We found that cooperative members not only had stronger economic outcomes, but also stronger safety nets that helped them in times of crisis. We also conducted a five-year longitudinal study that looked at how people rely on their cooperatives when they experience shocks, such the Covid-19 pandemic, a flood, or a drought. We found that people really count on their cooperatives to overcome shocks and stresses. We also saw that cooperatives were more resilient during the pandemic than other businesses. They were more likely to stay in business and support their members and communities around them. We know that cooperatives are a way for folks who generally work more independently, like agricultural producers or motorcycle taxi drivers, to share business risks and rewards with their fellow cooperative members. This increases their ability to withstand challenges and become stronger in the long run.

Paula: What is the most important lesson learned from the first phase of CLEAR? How are you planning to apply it within CLEAR+?

![]()

Ashley: I cannot overemphasize the importance of education and awareness among cooperative stakeholders about the worker cooperative model and its potential to effect meaningful change. For CLEAR, this took quite a bit of time and we had to redesign some of our activities to include training and advocacy around the worker cooperative model. To this end, we partnered with the Democracy at Work Institute – a reputable training institution in the United States – to design training materials around this model. We use these materials not only with nascent worker cooperatives, but also with cooperative developers, local government institutions, and some of our fellow cooperative development organizations, both Kenyan and international. This focus on advocacy and education was really critical for the program and its long-term impact. I would add that establishing strong, trusting relationships with government stakeholders in Kenya was also vital for the success of our policy and enabling environment activities.

Paula: CLEAR+ will focus on supporting worker cooperatives in Kenya and Guatemala. What are the top three things that the public should know about the worker cooperative model?

![]()

Ashley: The most exciting aspect of the worker cooperative model is its applicability to many different sectors and industries. We know that globally people are moving towards urban centers. We also know that young people are less and less interested in agriculture. As the population of youth is growing in many countries, we need to think creatively about how to ensure that young people have access to good jobs with high earning potential. From my point of view, the worker cooperative model opens a lot of doors for young professionals in sectors that traditionally attract independent entrepreneurs, for example motorcycle taxi drivers or auto mechanics. Worker cooperatives allow young people to come together, learn from each other, and benefit from common resources, such as shared workspaces or marketing and financial management services. It is simply much cheaper to co-own or co-rent a workshop or a garage than manage it yourself.

Another great thing about this model is that worker cooperatives can be much smaller than traditional agricultural cooperatives, many of which have hundreds or even thousands of members. A worker cooperative can be as small as 2 or 3 members, dependent on the laws of a particular country. This creates a lot of opportunities for smaller cooperatives that are more niche.

Paula: Worker cooperatives are less known and typically less valued than other types of cooperatives. Why? What are some of the key cultural misconceptions about this model?

![]()

Ashley: The biggest misconception is that cooperatives are agricultural in nature. Many people don’t know that the cooperative model can be applied to other sectors too. When they think of cooperatives, they think of corn and dairy, and of individual farmers who are dropping their goods off at a cooperative and getting paid. The worker cooperative model can be confusing, because the employees are also the members. Instead of having a product to sell to a cooperative, they are contributing their time, labor and expertise. Another misconception about the worker cooperative model is that members are always looking for the next opportunity, for the next best thing. But in a worker cooperative, the workers are, in fact, the co-owners. They are proud of their company, and they want it to succeed. So, if structured in a solid way, a worker cooperative can provide long-term livelihood solutions for its members.

Paula: CLEAR+ will be implemented in Kenya and Guatemala – two very different contexts legally, culturally and linguistically. How will the program address these differences?

![]()

Ashley: We have a fantastic opportunity to take the lessons learned in Kenya and apply them in Guatemala, which is CLEAR’s new implementation country. We’ve learned a lot about how to build awareness and create buy-in around the worker cooperative model, which we will definitely employ in Guatemala. We will also continue to work with the Democracy at Work Institute, which is excited to translate and adapt their materials to the Guatemalan context. One of the reasons we picked Guatemala is because it is ripe for opportunity in the service sector. The country has a booming tourism economy, where we think the worker cooperative model will make great impact. Guatemala also has a very large artisanal community working on weaving and beading and even creating artisanal food products like coffee and honey. I am certain that Guatemalan artisans will thrive in worker cooperatives, benefiting from the security and shared resources these cooperatives offer.

Another lesson that we will apply in Guatemala is using a market systems approach and working more closely with local business service providers. Rather than directly coaching worker cooperatives, we will invest in Guatemalan entities to train and mentor them. It is my hope that this relationship will continue long past CLEAR+, leading to greater sustainability of our program.

Paula: CLEAR+ will also seek to improve the enabling environment for worker cooperatives through legal and policy reform. What are some of the most common regulatory challenges that hinder the ability of worker cooperatives to thrive?

![]()

Ashley: The enabling environment framework is very important in the cooperative development sector. Unless cooperatives operate in a legal and sociopolitical system that allows them to thrive as businesses, they cannot achieve their full potential. When cooperatives are not treated in the same way as other businesses from a legal perspective, their earning capacity is impaired, and they are less profitable. For example, taxation is often a problem. Some legal systems do not have a clear definition of a cooperative as a business enterprise, which creates confusion about how cooperatives should be taxed. When regulatory gaps like this exist, cooperatives may get double-taxed or taxed at a higher rate. We always look at this issue when reviewing an enabling environment for worker cooperatives in new contexts.

Another issue is the number of members required for registration. Policies are often created around agricultural cooperatives, which are the most common in most countries. If a policy is written with agricultural cooperatives in mind, it may require 50 members to register a worker or housing cooperative. This requirement can be next to impossible for nonagricultural cooperatives to meet. We are advocating for revisions to this requirement both in Kenya and Guatemala to allow much smaller cooperatives to register and operate successfully.

Paula: How will CLEAR+ promote gender equality and positive youth development in two very different cultural contexts?

![]()

Ashley: Cooperatives typically have diverse membership and inclusive policies. In many countries, however, there are usually more men than women within those cooperatives. It’s also very challenging for women to secure leadership positions on cooperative boards and management teams. To address this issue, CLEAR+ is working with cooperatives in Guatemala and Kenya to help them create systems and structures that not only encourage women and youth to become active members, but also to take on leadership roles. Sometimes this requires very simple solutions, like ensuring that meeting times are convenient for women and young people or setting goals for cooperatives to have certain numbers of women or youth on their boards. One of the main ways we hope to be more inclusive within CLEAR+ is to support sectors which attract women and youth, such as the tourism and artisanal sectors. We know that many women are already working in these sectors as independent entrepreneurs. We also know they could really benefit from the formation of cooperatives.

Paula: Looking into the future, what innovations or advancements do you foresee in the field of cooperatives? How might Global Communities capitalize on them?

![]()

Ashley: We are seeing a lot of interest among cooperatives to incorporate more technology into their operations and marketing efforts. Many cooperatives we have supported in Kenya have had a lot of success with social media marketing and the use of simple technologies, like mass text messaging, to communicate with their members and current or potential customers. This has made a really big difference. We had one cooperative that offered a training on solar engineering. Because of the social media marketing they did, they maxed out the number of registrations, which had never happened to them before. Young people and worker cooperatives are really hungry for these technological advancements. Also, I would argue that the worker cooperative model is innovative itself because it can be applied to unique and diverse sectors. Within CLEAR, we have one cooperative that works in the acting and drama space. Utilizing the worker cooperative model with them has been very exciting.

One of the innovative aspects of the CLEAR program was our focus on accessible ways to disseminate information and training. We created a series of 30 short training videos that would accompany in-depth training that cooperative leaders were receiving through the program. Cooperatives have access to those videos on our YouTube page. They can go back to them at any time as either a refresher or to train a new board member. The videos cover such issues as financial management, governance, communication with members and gender inclusivity.

Paula: How are CLEAR and CLEAR+ planning for the longevity of the worker cooperative model?

![]()

Ashley: As we all know, USAID and the development sector in general are very interested in sustainability and localization. In CLEAR+, we apply these principles by utilizing a market systems approach to supporting worker cooperatives through their inception, start up and registration. In Kenya, we engaged several professional business service providers which helped the cooperatives design business and financial plans. We found this to be a very strong approach, but it takes time and effort to create these types of relationships. In CLEAR+ we decided to employ a market systems approach and create an environment where cooperatives are interested and willing to engage professional service providers trained on the cooperative model. We’re very hopeful that connecting service providers and cooperatives will create more opportunities for them to work together in the future. At the beginning, the program will provide scholarships to cooperatives to purchase these services. We trust that gradually our cooperatives will be able to afford these services themselves. We will also create a working group of service providers so that the CLEAR+ program can provide capacity strengthening and mentorship to them throughout the life of the program. When CLEAR+ wraps up in five years, we will have a very strong network of service providers which are working with cooperatives and can continue to scale up the worker cooperative model in both Kenya and Guatemala.

Paula: Thank you for your time! How can our readers learn more about your work?

![]()

Ashley: To learn more about cooperative development, please visit our website and read a recent story, Collaborating for Impact in Kenya’s Cooperative Sector. I also encourage you to watch our recent webinar, Beyond Inclusive Economic Growth: Harnessing the Power of Cooperatives and Savings Groups to Strengthen Resilient Communities. If you have questions about our programs, please email us at [email protected]. You can also find me on LinkedIn.

Ashley Holst

Ashley Holst is a Senior Technical Specialist of Cooperatives and Inclusive Businesses at Global Communities and supports the Cooperative Leadership, Engagement, Advocacy and Research (CLEAR) program in Kenya, along with supporting the overall cooperative technical area. She earned a master’s degree in International Development, specializing in Monitoring & Evaluation from American University in Washington, D.C., and an undergraduate degree in Sociology and International Political Science from Drury University in Springfield, Missouri.

Global Communities is home to a diverse team of professionals with a broad range of expertise and perspectives that help us build the world we envision: one of expanded opportunity, where crises give way to resilience and all people thrive. In our new “Pass the Mic” series, our global staff share innovative ideas and in-depth insights on timely topics spanning the development, humanitarian and peace nexus. Learn how our colleagues are co-creating a more just, prosperous and equitable global community.

The post Pass the Mic: Growing from Our Roots: Exploring the History and Future of Cooperative Development Programming at Global Communities appeared first on Global Communities.

]]>The post New USAID-funded Program to Strengthen Worker Cooperatives in Guatemala and Kenya appeared first on Global Communities.

]]>CLEAR+ is designed to improve the enabling environment for cooperatives, enhance the capacity of cooperative businesses, and create evidence-based tools that can be applied by cooperative development programs around the world. The program will elevate the worker cooperative model in both countries, with a special focus on women and youth engaged in the gig economy and service sectors.

“Worker cooperatives are less known and typically undervalued than other types of cooperatives, for example agricultural cooperatives. Yet they offer invaluable economic advancement opportunities for individuals in sectors that traditionally attract independent entrepreneurs, such as taxi drivers, artisanal creators and actors,” said Ashley Holst, CLEAR Chief of Party. “I am very excited that we can take lessons learned from our CLEAR program in Kenya and apply them to strengthen worker cooperatives in Guatemala.”

In line with the principles of sustainability and locally led development, Global Communities is poised to apply a market systems approach in CLEAR+. The program will engage local business service providers to coach cooperatives through their inception, start up and registration, rather than supplying these services directly. CLEAR+ will also support the cooperative enabling environment to reduce legal and policy barriers that small worker cooperatives often face, for example in registration, taxation and access to finance. Finally, CLEAR+ will promote gender equality and positive youth development in both countries by advancing women’s and youth’s leadership in cooperatives and focusing on sectors that are appealing to them, such as tourism, technology and the artisan industry.

“Global Communities’ history is deeply rooted in the cooperative movement. The organization was created in 1952 as the Foundation for Cooperative Housing and has supported housing and worker cooperatives in many countries around the world,” said John Holdsclaw IV, Global Communities’ Trustee & President and CEO of Rochdale Capital. “I am thrilled that Global Communities will continue to promote inclusive economic growth and locally led solutions through cooperative development for the next five years.”

For more information, visit our website and watch the recent webinar organized by Global Communities.

About Global Communities:

Global Communities works at the intersection of humanitarian assistance, sustainable development and financial inclusion to save lives, advance equity and secure strong futures. We support communities at the forefront of their own development in more than 30 countries, partnering with local leaders, governments, civil society and the private sector to achieve a shared vision of a more just, prosperous and equitable global community. Learn more at globalcommunities.org.

The post New USAID-funded Program to Strengthen Worker Cooperatives in Guatemala and Kenya appeared first on Global Communities.

]]>The post Catalyzing Success for Sri Lanka’s Women Entrepreneurs through SCORE appeared first on Global Communities.

]]>Over the past five years, SCORE has been working to reduce socioeconomic disparities and strengthen cohesion and resilience among multi-ethnic and multi-religious communities, with a special focus on supporting marginalized women and youth.

In the aftermath of the COVID-19 pandemic and in response to the economic crisis that is currently engulfing Sri Lanka, the program intensified its efforts by working with a select group of women who were severely impacted by these shocks and stressors—from widows and single mothers to women-headed households. While some had micro businesses or entrepreneurships, others were daily wage earners, unemployed or engaged in unpaid domestic work such as home gardening and farming.

“Some, if not most, were not treated with respect or dignity within their household or community, because they were seen as dependents and not as a segment that could bring in an income to their household,” said Avanthi Kottegoda, Head of Program & Learning for SCORE. “With COVID-19 and the economic crisis, they were even more vulnerable, subject to abuse and in dire need of support due to the loss of their spouse’s income or their own earnings.”

To help address these challenges, SCORE provided the women with access to specialized tools, technology and training to start, strengthen and grow new or existing micro-enterprises. Support included market analysis and opportunities for them to develop their business and financial management skills.

“These are all resilient women here. No one said, ‘I can’t’ or ‘No.’ They stood up for themselves let it be COVID-19, the Easter Attacks, the economic crisis — they found alternative ways to move forward and were agile,” said Aranee Devanandan, Manager – Social Capital at Hela Apparel Holdings.

Devanandan was one of several guests at the SCORE Women in Action event, which offered a chance for women entrepreneurs who participated in the program to network with potential buyers, investors and advisors from the government sector. Invitees included representatives from leading supermarket chains and apparel companies as well members from the Industrial Development Board and the Board of Investment of Sri Lanka. Wasantha Perera, Secretary to the Ministry of Justice, Prison Affairs and Constitutional Reforms, was in attendance, in addition to Deepthi Lamahewa, Executive Director of ONUR.

“Four of our members take our products to weekly fairs across the Monaragala District. Now, even the male family members go to the weekly fair and sell our products. We want to go beyond this,” said Ranjani, a member of a women’s collective known as Jayamal Product that produces and sells spices, grains and other products such as flour and jaggery. SCORE provided the collective with the machinery they needed for the production process, along with training to build members’ entrepreneurship skills.

“For example, maintaining books of accounts, and we learned how to work cohesively as a team,” Ranjani said.

Previously, none of the women involved with Jayamal Product had any means of earning an income. Now, Ranjani said she has been able to make approximately 40,000 Sri Lankan Rupees per month and noted benefits that extend past turning a profit.

I feel that life has gotten better in so many ways. That’s the change.”

Ranjani, Jayamal Product Women’s Collective, SCORE participant

“Some of the group members’ husbands did not let them participate in activities previously. One member’s husband didn’t even let her leave the house. Now she comes out and engages with us very happily,” Ranjani shared. “She herself says that she is now able to talk well, that she has strength and that she has standing within her family and within the village. Like that, I feel that life has gotten better in so many ways. That’s the change.”

SCORE Women in Action was another chance for her, members of Jayamal Product and other women entrepreneurs involved in the program to put what they have learned into practice.

“We got an opportunity today,” Ranjani said of the event. “We are meeting a representative from a leading supermarket tomorrow with product samples.”

In June, SCORE facilitated a gap analysis workshop with women micro-entrepreneurs engaged in the textile industry. Workshop findings were shared at SCORE Women in Action to support the Government of Sri Lanka and private sector with making policy-level decisions and investments that could improve both the industry and lives of women micro-entrepreneurs involved in it.

The event also included a session facilitated by Amira Ghaffoor, a woman tech entrepreneur who shared how to use digital technology to grow and enhance micro-enterprises. SCORE program participants like Damayanthi, who runs Uttara Fashion in Monaragala, left determined to apply what they learned and to continue adding to their skill set.

“I was able to gain a lot of knowledge from coming here – how to take the business forward, what I should be doing. It would be good to have more events like this,” she said. “The more knowledge we have, the more we can develop our businesses. After listening to the session on digital technology, I am motivated to use Facebook, WhatsApp and other social media platforms to promote my business.”

During the COVID-19 pandemic, Damayanthi said her shop Uttara Fashion suffered greatly. With support from SCORE, she was able to acquire sewing machines and other equipment needed to raise the quality and output of her products. Now, she has 10 machines, employs five people, and her confidence has grown alongside her business.

“I can take on orders for any frock design,” Damayanthi said, adding that her daughter has been studying fashion design for the past year to help take the shop to the next level.

According to Jeyathevan Kaarththigeyan, Chief of Party for SCORE, success stories like Damayanthi’s and that of other women entrepreneurs supported by SCORE have laid a strong foundation from which the program plans to build.

“Through economic empowerment, SCORE promotes diverse entrepreneurs to have a sustainable and cohesive environment in the working districts. Through scaling up and networking, we would like to expand this to the entire country,” he said. “In addition to replicating the SCORE models for women engagement in economic empowerment, we would also like to link these entrepreneurs with other successful models to ensure sustainability and promote cohesion.”

The post Catalyzing Success for Sri Lanka’s Women Entrepreneurs through SCORE appeared first on Global Communities.

]]>The post Fostering Financial Stability: Co-op Savings Group in Zambia Fuels Women’s Mutual Growth appeared first on Global Communities.

]]>Education and healthcare are crucial for any young person, but they take on special importance in Zambia, where an estimated 1.3 million orphans and vulnerable children and adolescents (VCA) are infected with, or affected by, HIV.

As a VCA caregiver, Munkombwe is one of many women in her area who has had to grapple with this reality. But thanks to a cooperative savings group supported by the United States Agency for International Development’s Empowered Children and Adolescents Program II (USAID ECAP II) and facilitated by Project Concern Zambia (PCZ), a Global Communities partner, her situation has improved significantly.

Munkombwe is one of 20 women who belong to the Tusekelele women’s savings group, which was formed in May 2022 in the Kalomo District of Zambia’s Southern Province to strengthen the economic status and financial literacy of vulnerable households. All of the participating women are taking care of at least one child or adolescent with HIV or with HIV vulnerabilities, such as having an elevated risk of HIV acquisition, being the child of a female sex worker or being a victim of gender-based violence.

“Tusekelele” means “let’s celebrate” in Tonga, and it’s with that attitude of positivity that the group operates. The women meet weekly to save money; lend money they are saving to each other to help meet the health, social and economic needs of their households; and discuss HIV, sexual and reproductive health, gender and socioeconomic issues affecting them. Specially trained facilitators provide guidance and mentorship on savings principles, basic financial literacy and income generation ideas, as well as guide them through group discussions and connect them to relevant health and livelihood programs in their communities.

Furthermore, USAID ECAP II partnered with First National Bank (FNB) in Zambia to train the women on how to access credit for their income-generating activities and open savings accounts with established financial institutions. PCZ also worked with FNB to create a strategy aimed at linking savings groups’ small businesses to markets.

In early 2023, with USAID ECAP II’s support, the Tusekelele women’s savings group successfully registered as a cooperative and received a grant of 12,000 Zambian kwacha from the Constituency Development Fund, an initiative of the Zambian Ministry of Local Government and Rural Development. The women invested the money into their shared chicken-rearing business; the returns from the investment are reinvested into the group’s savings pot and accessed as loans by the members.

The participating women report that the group has had real impact on their economic situations. When they joined, most members simply sold vegetables, but they have since diversified their small business to include other products such as groundnuts, tubers like cassava and sweet potatoes, maize grains, brooms, beans and peas.

“We have learned how to save money, budget, have business ideas as well as encourage each other to live healthier lives,” Munkombwe explained. “I started saving with 20 Zambia kwacha. By the end of the first cycle, I had 1,200 Zambian kwacha, and in the second cycle I now have saved 5,720 Zambian kwacha.”

Munkombwe said she believes her particular business is well on the road to being self-sustaining, thanks to the group. But the positive changes that she has experienced aren’t limited to finances.

“My children can now go to school and remain in school without worrying that they will go to school on an empty stomach, or they will not have transport to go to school and miss school altogether,” she said. “We are now able to access medical services we need and pay for all the drugs we need.”

The post Fostering Financial Stability: Co-op Savings Group in Zambia Fuels Women’s Mutual Growth appeared first on Global Communities.

]]>The post How Vitas Jordan is Supporting Medical Centers through a New Digital Loan Product appeared first on Global Communities.

]]>The COVID-19 pandemic exposed weaknesses in the global medical supply chain. Shortages of personal protective equipment (PPE), ventilators and medications made it challenging for hospitals and clinics to treat patients and contain the virus. In Jordan, where public hospitals lacked beds and ventilators, the government ramped up domestic production of PPE and worked with outside suppliers to acquire ventilators to keep up with demand.

To solve supply chain challenges and provide a new way for medical providers to acquire supplies and equipment, three biomedical engineers launched an innovative eCommerce service in Jordan called Medical Hub.

“It wasn’t easy to order all the medical supplies from different vendors,” said Yousef Al-Shobaki, owner of Jwan Medical Center. “Using Medical Hub as an aggregator and one window to order all needed supplies made getting the products we needed easier.”

Despite Medical Hub’s ability to simplify the procurement process, medical centers — like Jwan — still struggled to obtain the necessary cash flow to make medical supply purchases. To address this challenge, Vitas Jordan — a for-profit subsidiary of Global Communities — created a new, innovative loan product that supports medical facilities with funding their orders.

“Vitas Jordan was keen to implement new innovative services like this, because it promotes the adoption of emerging technology and solutions through providing financial services to medical providers,” said Osama Barakat, head of the Commercial Unit at Vitas Jordan.

To test new loan products that use technology, connect clients to products or services that meet their needs and solve business pain points, Vitas Jordan launched a mini-innovation lab. The mini-lab’s first prototype was the Revolving Line – Invoice Financing Loan, which was introduced in 2021. This product is currently one of the few that enables healthcare providers and clinics to finance medical supplies.

The Revolving Line – Invoice Financing Loan is very flexible and free of hassle which saves our medical center time.”

Yousef Al-Shobaki, Owner, Jwan Medical Center

“It is delightful to see Vitas Jordan adopting this culture of innovation and including the model of ‘financing through platforms’ into its business plan,” said Rola El Amine, Vitas Digital Business Innovation Manager. “It has been a challenging journey to look out for the right platform/partner in Jordan, but the team’s determination succeeded to create financing impact in the healthcare sector through its partnership with Medical Hub.”

The Revolving Line – Invoice Financing Loan allows Vitas Jordan clients to purchase medical products from Medical Hub as needed rather than having to wait for funding to become available. Onboarded Vitas Jordan clients can draw from the loan and pay it back multiple times without requesting a new financing agreement as long as purchases fall below the loan ceiling limit.

Medical centers can select needed supplies like bandages, syringes, needles, oxygen masks and other medical equipment for their clinics and hospitals through Medical Hub’s website. At checkout, clients can then request payment be completed through a Vitas Jordan loan. From there, Medical Hub sends the financing request via email to Vitas Jordan, where the team reviews the order and approves the plan. Once the purchase is completed, Vitas clients log into Tijarah, a business-to-business digital supply chain financing platform, to initiate the withdrawal request. Tijarah is also the place where clients and Vitas Jordan connect to confirm ordered goods have been received and invoices to Medical Hub are paid.

To test the viability of the Revolving Line – Invoice Financing Loan, Vitas Jordan launched a pilot loan with the Jwan Medical Center, which treats roughly 1,000 patients per month and has been a partner of Vitas Jordan for the past three years. The center was granted an initial loan of 30,000 Jordanian Dinar ($42,325.05) and the first invoice was for a withdrawal of 500 JD, which the center paid back in January 2023.

“The Revolving Line – Invoice Financing Loan is very flexible and free of hassle which saves our medical center time,” Al-Shobaki said. “This loan helped improve our efficiency.”

Through the pilot loan to Jwan Medical Center, the Vitas Jordan team learned about the importance of understanding a client’s needs, being flexible and closing the loan cycle quickly. These takeaways will be implemented as the Revolving Line – Invoice Financing Loan moves into the next developmental phase.

Learn more about other Vitas Group financial innovations in Lebanon and Iraq.

The post How Vitas Jordan is Supporting Medical Centers through a New Digital Loan Product appeared first on Global Communities.

]]>