News > Blog

Improving Urban Resilience through Insurance Innovations in Colombia

Published 07/24/2023 by Global Communities

By Lizzie Hickman

On July 4, 2023, the Earth saw its hottest day since at least 1979, highlighting the increasing impact of climate change and extreme weather patterns. Medellín, Colombia, is particularly at risk of climate-related disasters due to its terrain and rainfall patterns.

Colombia ranks 10th in terms of economic risk posed by natural hazards, with the country facing the highest recurrence of extreme events in South America. Approximately 84% of the population and 86% of its assets are in areas exposed to two or more hazards. In Medellín, 4.45% of the territory is at a high risk of floods and flash floods, while 20% is at a high or medium risk of landslides.

To address these challenges, Global Communities partnered with the Insurance Development Forum (IDF), represented by Hannover Re (an insurance company) and Willis Towers Watson (a global advisory, broking and solutions company), to form a public-private partnership consortium. Our goal was to promote resilience in communities vulnerable to natural catastrophes by developing natural disaster risk insurance products for the City of Medellín. The InsuResilience Solutions Fund (ISF), managed by Frankfurt School of Finance and Management (FS) and funded by KfW Development Bank, provided co-funding for the product development of the insurance solution. The project, which was implemented from 2018 to 2023, has now concluded but can provide lessons for similar initiatives in other districts of Antioquia and throughout Colombia.

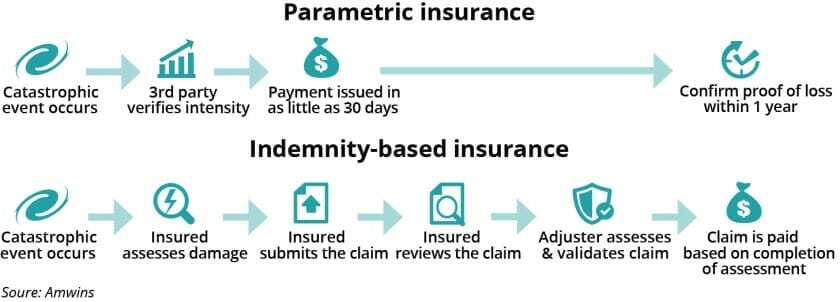

The ISF project aimed to improve urban resilience in Medellín by providing the city with financial protection for climate risks and natural disasters. The consortium, consisting of Global Communities, Hannover Re and Willis Towers Watson, specifically developed an innovative insurance solution for flooding, landslides and earthquakes to protect the city of Medellín. This type of insurance, referred to as parametric insurance, provides pay-outs when specific parameter triggers, such as rainfall measurements, are met. The triggers are established by analyzing historical data on previous hazard events, the resulting damages and losses, and the current level of exposure and vulnerability of the people and assets to be covered. Compensation payments are made if certain triggers meet or surpass a pre-defined threshold, eliminating the need for on-site verification of losses and damages. This approach enables faster and more efficient insurance payouts.

The first step of the project involved identifying the data sources to be used for the parametric model. Global Communities, in collaboration with project partners, collected seismic and rainfall information for comparison with historical disaster data that had impacted the city. This data helped determine the conditions of the insurance product. Seismic information was obtained from the Colombian Geological Service, while rainfall data — crucial for assessing flood and landslide risks — was provided by the Aburrá Valley Early Warning System (SIATA). Weather pattern information was also obtained from the Administrative Department of Disaster Risk Management (DAGRD) to create a record of previous natural disasters in Medellín.

During the implementation phase, the project encountered challenges related to gathering climate data, the absence of regulation for parametric insurance, and establishing public-private partnerships. Although it was known beforehand that 56.8% of economic losses in Colombia are caused by floods, 11.3% by earthquakes and 8.3% by landslides, there was no centralized system for tracking existing data. This made it difficult to determine the cost of natural disasters on the public administration in Medellín. However, as a result of the project, a hierarchy was established to track the most relevant flood emergencies caused by natural factors, and this data was organized and used based on this establish hierarchy.

The ISF project was the first of its kind to bring parametric insurance coverage that addresses flooding, landslides and earthquakes in Medellín. Key successes included:

- Tailoring the project to the specific needs of the Medellín District based on local information from the Aburrá Valley Early Warning System for flood and landslide risks;

- Designing a tailor-made insurance coverage across the Medellín District, including its 16 communes and five corregimientos; and

- Engaging the Municipality of Medellín as the client for the risk transfer solution through the Municipal Fund for Disaster Risk Management (FONGRED).

In addition to these achievements, the project made valuable contributions by enhancing technical capacities, promoting knowledge sharing and addressing local barriers, including:

- Enhancing the technical capabilities of the DAGRD team in managing and acquiring parametric and insurance products;

- Raising awareness among relevant stakeholders about risk transfer solutions through information and expertise sharing;

- Assisting the insurance industry in understanding local barriers to developing risk transfer products; and

- Facilitating the exploration of new approaches and ideas in product development with stakeholders.

Download this resource for a complete overview of the ISF project, including challenges and lessons learned that can inspire and inform new projects to improve risk management for natural disasters.